The Ghana Revenue Authority (GRA) has responded to concerns raised by the Abossey Okai Spare Parts Traders Association regarding the new Value Added Tax (VAT) regime under the VAT Act 2026 (Act 1101).

According to a statement, the GRA noted that claims of price increases and market distortions are unfounded.

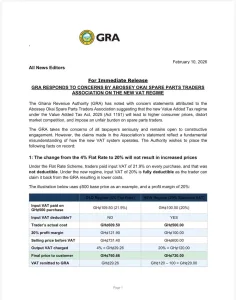

The Authority explained that changing from a 4% Flat Rate to a 20% VAT will not result in higher consumer prices because the new 20% VAT is fully deductible, allowing traders to claim input VAT back and reduce costs.

A GRA example with a ₵500 base price shows the final customer price under the new regime (₵720.00) is actually lower than under the old regime (₵760.86), giving traders an advantage from lower base cost and full input VAT deductibility.

The GRA also clarified that raising the VAT registration threshold to ₵750,000 does *not* cause price or market distortions, as registered traders can now deduct input VAT, simplifying compliance and easing administrative burdens for small businesses.

The new VAT regime offers several benefits: the effective tax rate is lowered from 21.9% to 20%; the COVID-19 Health Recovery Levy has been abolished; registered businesses enjoy full input VAT deductibility; cascading taxes are eliminated; and the cost of doing business is reduced by nearly 18% for some sectors.

The GRA remains open to constructive engagement with taxpayers to ensure proper understanding of the new VAT system.

Read statement below: