The National Chairman of the Ghana Private Road Transport Union (GPRTU) has commended the National Insurance Commission (NIC), for coming to the rescue of their members in the commercial transport sector and bringing sanity on to our roads.

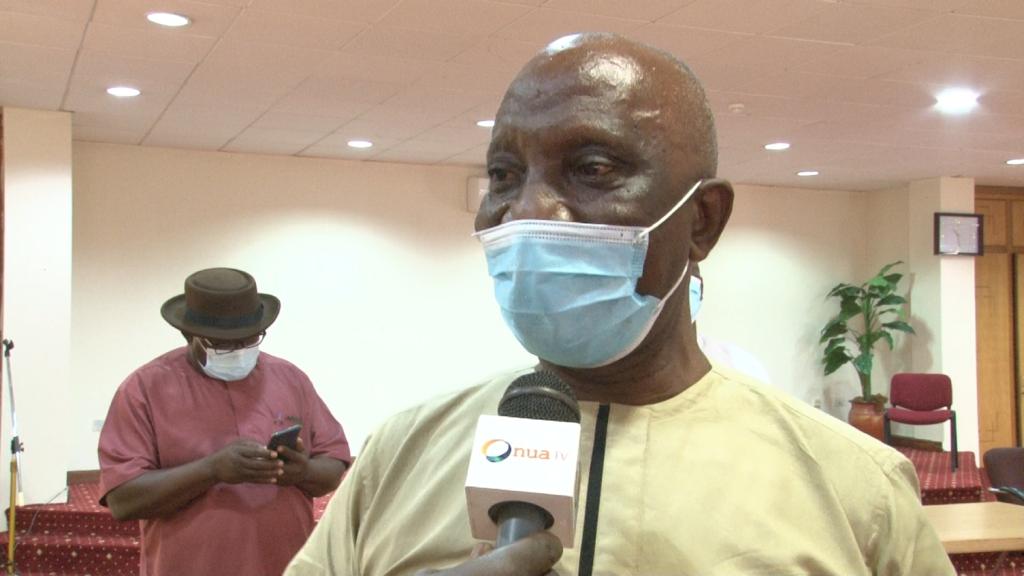

The Chairman, Nana Breshima and other National and Regional Executives of the GPRTU paid a courtesy call on the Commissioner of Insurance, Dr. Justice Yaw Ofori, to commend him on the leadership role he played in the implementation of the Motor Insurance Database (MID), which he noted, has significantly reduced the incidents of fake insurance policies procured by their members which was often realised only after an accident occurred.

The Executives together, noted that since Dr Ofori took over the mantle of the National Insurance Commission (NIC), they [transport industry] have conspicuously noticed the sanity he has brought to the insurance industry.

They, have however, requested the Commissioner to do something about the ‘No Premium, No Cover’ policy, as most commercial drivers have come to appreciate comprehensive insurance policies over third party insurance covers.

According to the General Secretary, Godfred Akulbre, while some of their members wish to buy comprehensive motor insurance they are compelled to go in for just third party covers just because, they are unable to pay the premiums upfront.

In his response, Dr Justice Yaw Ofori, expressed his appreciation for the recognition and the role the GPRTU executives, both at the national and local levels, played when the MID was about to be implemented.

Reacting to the desire by their members to purchase comprehensive motor insurance as against third parties, Dr Ofori described the request as a commendable approach, especially by commercial who hitherto, bought insurance just to satisfy police checks.

He revealed to the executives that if a comprehensive insurance policy appears to be unaffordable by a motorist at a go, there is also an opportunity for taking monthly and even quarterly packages. This he explained, has been available on the insurance market and urged the drivers to take advantage of such an arrangement.

It came out that leaders of arguably the most famous transport union, had no knowledge about this. They were, therefore, encouraged to request such from insurance companies and where they are not receiving good customer service for such arrangements, they should quickly resort to the NIC to have the insurance companies to comply.

Dr Justice Ofori was appointed as Commissioner of Insurance by the President, Nana Addo Dankwa Akuffo-Addo in 2017, after serving in his capacity as the first Director of the Ghana Insurance College.

The NIC under his leadership appeared as one that has been reborn as many reforms have taken place while more are still in the offing.

Full of energy, discipline and tenacity, Dr. Justice Ofori held on tightly to the government’s digitisation agenda by introducing and implementing the Motor Insurance Database (MID), a central platform on which no validly insured vehicle could ‘escape’.

He was particularly motivated to reduce significantly, the number of vehicles with fake insurance policies plying our roads and was instrumental in ensuring that the menace was curbed as families and livelihoods were being affected especially in the event of road accidents.

Following the successful discussions, the Dr Ofori announced the intention of the Commission, to organise training sessions for drivers across the country. This, he believes, would largely create more awareness as regards the rights and responsibilities of motorists.

He indicated how passionate he is about insurance education after leading the Commission to institute the training of personnel of security agencies including the Ghana Police Service MTTD, the Ghana National Fire Service, among several others just to make them understand insurance.

He said, he believes in the fact that an educated people on insurance, means appreciation of insurance rather than the feeling of compulsion to take up insurance.

His establishment of an insurance educational fund to promote insurance awareness in Ghana was further highlighted by his target of training 10,000 youth as insurance agents, to boost the manpower needs of the insurance industry and also to engender professionalism among practitioners at any level.

The GPRTU is the third largest group of professionals apart from the Chartered Insurance Institute of Ghana (CIIG) and the Ghana Journalists Association, which recognised his transformational leadership by conferring on him an ‘Honorary Member of the Ghana Journalists Association (GJA) at its 25th Awards Ceremony.

For him, as he explained to the GPRTU executives, the policyholders’ interest and protection is so dear to his heart. as that is what forms the basis of the Commission’s mandate.

The GPRTU expressed that Dr. Justice Ofori is a game changer and more is expected from him in the coming years.